Do you work as a CEO, sales manager or marketing manager at a tech startup? If you want to increase your sales quickly, you need to keep two things in mind. One is that you cannot scale before you have a scalable offering. The other is that, when you scale, you need to adapt your growth strategy to where the offering is in the Technology Adoption Life Cycle. So, how do you do that? Continue to read this blog or check out this webinar to learn more.

What startups are and why society needs them

First of all, we have to go through the basics. What is a startup? A startup is a company that tries to find its business model and establish a scalable and repeatable business process. This represents the journey from being primarily financed with venture capital to becoming a profitable business with its own customers. It is a tough journey to make and we admire everyone who embarks on it, as not everyone succeeds. Startups are an important part of our society, not only to create new companies but also companies that want to solve important problems such as health, environmental and financial challenges.

“A start-up is an organization formed to search for a repeatable and scalable business model – Scott Blank”

Solve real-world customer problems with a product-market fit

One of the most common mistakes startups make is trying to solve a problem that customers don’t care about. It’s easy to fall in love with your own business idea and forget about what real-world problems customers actually have. So what do your customers care about and how can you help the?

“The most common mistake startups make is trying to solve problems no one has.” – Paul Graham, Author and Co-founder at Y Combinator

Product-market fit is the process of identifying a market that will become consumers of your product. There may be multiple markets in your product-market fit, but it’s an incredibly important first step when building a business to find at least one. If you’re not ensuring the product you’re building is aligned with a buyer persona, it’ll be difficult to scale. If you ultimately find a product-market fit, it means that you are in a market with a good segment that you can satisfy, sell to and make money on.

"Product-market fit means being in a good market with a product that can satisfy that market.” – Marc Andreessen

Two tips before scaling up

Scaling up is great, but you should be careful to have the right foundation in place first. These two tips will help you ensure you’re ready before taking this big important step:

- Do not scale up marketing and sales before you have a product-market fit. Use your money to buy yourself time to find it.

- 2. Spend more time than you think is necessary on the “problem side” and understand the customer, then double it.

What makes high-tech marketing different

Tech startups are often characterized by high risk and low data, making it difficult for them to sell. This is in contrast to consumer marketing, where you have low risk and high data, making it less risky to make a purchase because there is a lot of information. In B2B sales, there’s more money and a longer sales cycle involved. This means you have to convince someone to make a large investment in an untested startup.

Problems with high risk

- Unproven products and promises

- Incompatible and incomplete infrastructure

- Social resistance to change

Pitfalls of low data

- No product history

- No company track record

- No best practices

The Technology Adoption Life Cycle.

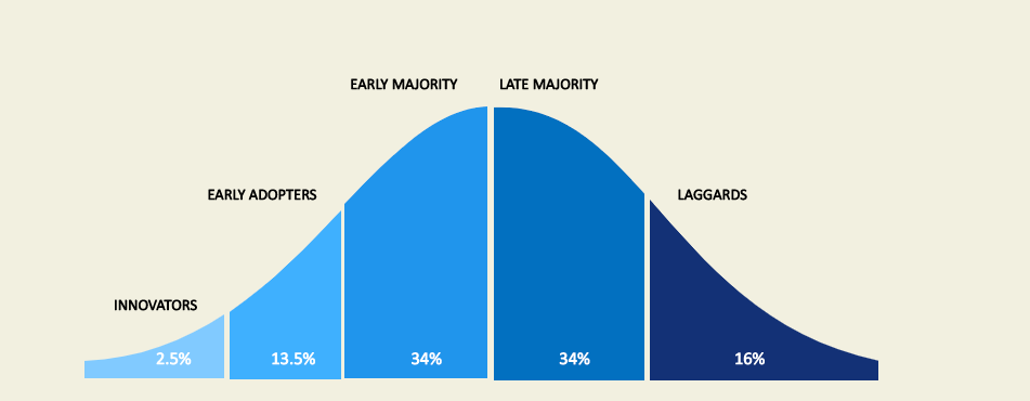

To address these long B2B sales cycles, it can be helpful to fall back on the research of Evan Rogers. In the late 1950s, Rogers explored what actually happens when you release a new technology to a group of people in his The Diffusion of Innovation. He divided that group into a model, The Technology Adoption Lifecycle.

Innovators “Technology Enthusiasts” (2.5%) – Innovators are the first individuals to adopt an innovation. Innovators are willing to take risks, are the youngest in age, have the highest social class, have great financial lucidity, are very social and have closest contact with scientific sources and interaction with other innovators. Risk tolerance has them adopting technologies which may ultimately fail. Financial resources help absorb these failures.

Early Adopters “Visionaries” (13.5%) – This is the second fastest category of individuals who adopt an innovation. These individuals have the highest degree of opinion leadership among the other adopter categories. Early adopters are typically younger in age, have a higher social status, have more financial lucidity, advanced education, and are more socially advanced than late adopters. They are more discrete in adoption choices than innovators.

Early Majority “Pragmatists” (34%) – Individuals in this category adopt an innovation after a varying degree of time. This time of adoption is significantly longer than the innovators and early adopters. The Early Majority tend to be slower in the adoption process, have above average social status, are in contact with early adopters, and seldom hold positions of opinion leadership in a system. A large share of the market is made up of the pragmatists, who say, exciting product but we will look further into it in a few years. They focus on proven market shares and would like to have a lot of reference indications and get in and check rankings to see who the top 3 providers are. This is a traditional middle manager who does not want to throw himself out.

Late Majority (34%) – Individuals in this category will adopt an innovation later than the average member of the society. These individuals approach an innovation with a high degree of skepticism and after the majority of society has adopted the innovation. The Late Majority are typically skeptical about an innovation, have below average social status, very little financial lucidity, are in contact with others in the late and early majorities, and have very little opinion leadership.

Laggards (16%) – Individuals in this category are the last to adopt an innovation. Unlike some of the previous categories, individuals in this category show little to no opinion leadership. These individuals typically have an aversion to change-agents and tend to be advanced in age. Laggards typically tend to be focused on “traditions”, likely to have the lowest social status, the lowest financial fluidity, be the oldest of all adopters, are in contact with only family and close friends, and have very little to no opinion leadership.

Identifying the chasm in the Technology Adoption Lifecycle

Crossing the chasm – marketing and selling disruptive products to mainstream customers, by Geoffrey Moore, was released about 30 years ago and modifies the thinking around the Technology Adoption Lifecycle. Before this, you only worked from right to left throughout the cycle. This did not work. Many startups crash long before they reach the mass market, even though they have new products and technology that could solve many problems. They never become profitable and, in the end, investors lose interest, and the company is forced to close down.

Morre asked what is really happening along the way. Then he came to the conclusion that the early market, which consists of the visionaries and technology enthusiasts, is interested in the latest product and buys for completely different reasons than the mainstream market, which is more interested in complete solutions and convenience. The pragmatists do not think that the reference material is good enough and may rather clean up after the early market. There is then a gap, “the Chasm”.

Two key considerations for getting pragmatists to invest in your startup

Considering this chasm, you’re challenged to figure out how to get these pragmatists to invest in your tech startup. What are they looking for and what can make you stand out? Here are two key considerations:

- Cross the chasm to the mainstream market to find your product-market fit. You can’t go from startup to scale-up until you have left the early market.

- You need a different market strategy for each market phase. This means you can’t just keep running with the same strategy for visionaries as for pragmatists.

Finding visionary customers in the early market

The trick is to identify visionary individuals working at large companies. These individuals need to be people who see the opportunity in the technology that you have. However, they may need to be at a larger company to gain access to capital and an interest in making a living from your offering. Sell it as a large consulting project and make adjustments to be able to build the solution for the company's unique requirements. Sell your technology and vision based on what it will become.

It’s a good idea to try looking for these individuals in different industries. The point is to compare public sector with private sector and vertical industries to find different problems they are interested in solving with your platform. A common mistake is to think you know what kind of problem you are solving, even though you have a fairly generic problem. Wait on segmenting the market and instead try to understand your customers first.

How to cross the chasm

Start by looking look to find and conquer a "beachhead segment”. This is defined as “A small niche segment consisting of pragmatists in pain with a marginalized use case.” These pragmatists, with what is a major problem to them but still a relatively minor problem overall, are the way to go. The reason is that, if you go for a big problem, you will not have time to get a foothold on the market before any of the larger companies have the chance to snatch the idea away from you.

The most important thing here is that you have a strong problem that you can solve, and that you can solve a compelling need. This is because pragmatists are more risk-averse. As a result, a startup like you can come in here and convince them that your offering can solve the problems.

Look for the following criteria to cross the chasm:

- Niche market with an intractable problem, not solvable by conventional means

- Pragmatists in pain

- Process owner is under pressure to find a solution

- Pragmatists who are willing to consider a disruptive approach

Have you chosen a beachhead segment that is small enough?

You have to invest in becoming the very best solution. You need to find a small segment where your startup has a chance within one to three years to reach the "fish to pond ratio". This means reaching between 40%-60% market dominance. Once you have found a small segment with a compelling need, you need to quality it and review whether there is a market there. Use the following questions to do this:

- Is the segment possible to find and communicate/sell to?

- Do they have money?

- Is there a competitor who dominates the segment?

- Can we create a "whole product” for the selected segment?

Going all in with a whole product

Have you checked all of the above? Then it's time to go all in on that segment! Going all in is better than spreading out thinly in different markets. That would result in you not being the best at anything. Commit to provide the "whole product”. Not only your core product is important but also your extended product. This means providing training and support and augmenting the product with partners, integrations and so on.

What a whole product is in summary

- A complete solution to the intractable problem

- Typically involves products and services from partners and allies

- Lead vendor takes responsibility for ensuring customer success

What category are you?

Another important part when defining yourself as a startup is to ask what arena you are playing in and who you are as a category. This determines a lot about how you are seen by a pragmatist. If you are good, you can define a new category. If you had the opportunity to define a new product, you would rather sell the entire category instead of an entire product. Then the goal is actually to become a leader in a category group. Because we know that the category leaders are the ones who make big money.

What to communicate to a beachhead segment

This needs to be defined before you start. Work on the following points to differentiate your offering from competitors

- For (target customer, beachhead segment)

- Dissatisfied with (current market alternatives)

- Our product is a (new or existing product category)

- That provides (key problem-solving capability)

- Unlike (the product alternatives)

- We have (key differentiator/key whole product feature)

Work the bowling alley

Once you have won one segment, this presents an opportunity to capture nearby segments as well. This is called the bowling alley effect. Now you’re finally in the driver’s seat with great upside.

Would you and your team at (company name) like to get more advice on how to become a scale-up? We offer growth workshops that result in a growth plan where we analyze your beachhead segment and go-to-market strategy.